The Dynamic Duo of Your Financial Future: How Estate Planning Lawyers and Financial Advisors Collaborate

When you decide it’s time to get serious about your future, you might be surprised to learn that you need not one but two professionals in your corner: an estate planning lawyer and a financial advisor. Many assume these roles are interchangeable or that one professional can handle it all. Spoiler alert: they are two […]

The Power of Trusts in Protecting Your Legacy

The Graceland scam highlights a chilling reality: when someone passes away, their estate often becomes public record. This means anyone, including opportunistic scammers, can access details about your assets and your beneficiaries. This vulnerability can lead to various schemes, from simple pressure tactics to complex legal maneuvers aimed at diverting your hard-earned wealth. How Trusts […]

Safeguarding Your Future as a Physician

If you’re a new doctor building your practice or a seasoned physician branching out on your own, it’s time to give serious thought to asset protection planning. Did you know that doctors are among the top professionals targeted in lawsuits? It’s not a matter of “if” but “when” you might face a claim. In New […]

Stepping In: What to Do as Trustee When Your Loved One is Hospitalized

Being named a trustee is an important responsibility, but sometimes life throws unexpected situations your way. When a loved one is hospitalized and you have to step into the trustee role, you might feel overwhelmed and uncertain about what lies ahead. Here’s a guide on how to navigate your new responsibilities and ensure your loved […]

New Home Contract? Now’s the Time to Consider a Trust

You’ve found your dream home and your offer’s been accepted – this is an exciting time! As you approach closing, your agent, attorney, or title company will ask how you’d like to hold the title to the property. While individual ownership is common, placing your new house into a trust right from the start has […]

How to Navigate Estate Planning Without Heirs

Many people mistakenly believe that without direct heirs—like children or grandchildren—there’s no need for estate planning. However, the reality is quite different. Even if you don’t have immediate family to inherit your assets, deciding how your estate will be distributed is crucial. If not, you might be surprised at who ends up with your hard-earned […]

Estate Planning Considerations for Veterans: Tips to Ensure Your Service is Honored

For those who have served in the military, estate planning takes on unique considerations. Veterans have earned specific benefits and honors due to their service, and it’s essential that these are incorporated into an estate and long-term care plan. Here are some key points veterans should consider: Safeguarding Your DD214 Your DD214, or Certificate of […]

Why Do I Need Someone to Witness My Will?

When it comes to estate planning, ensuring that your will is legally valid is paramount. One of the key components of a valid will is having witnesses present during its signing. But why is this step so crucial? Our estate lawyers delve into the importance of having witnesses for your will below. Legal Validation The […]

Flexibility and Considerations for Changing Beneficiaries on Your Life Insurance

Life insurance is a powerful tool to ensure that your loved ones are taken care of financially after you’re gone. But as life evolves, so do our relationships and priorities. A common question we encounter is: “Can I change the beneficiaries on my life insurance whenever I want?” Our will and trust attorneys dive into […]

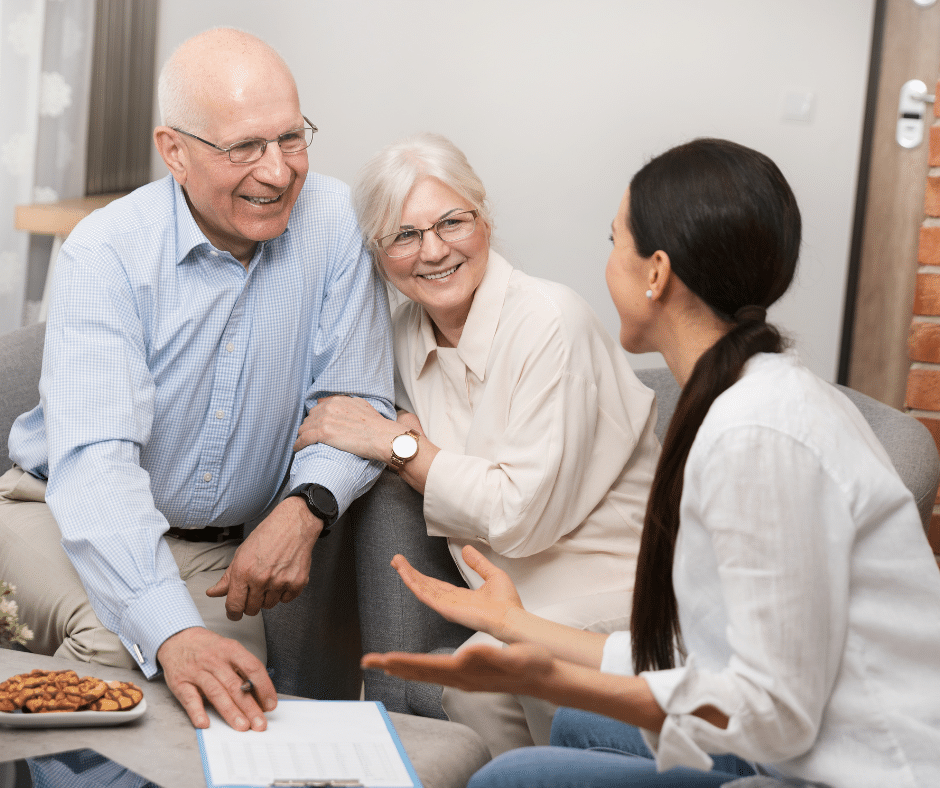

Broaching the Sensitive Topic of Estate Planning

Estate planning is a crucial topic, but it’s often cloaked in sensitivity, especially when older loved ones feel that their finances are private matters. Knowing how to navigate this conversation respectfully and effectively is crucial. Why It Matters Having a will and comprehensive estate plan ensures that your loved one’s wishes are carried out, minimizing […]