The need for affordable long-term support services has seen a dramatic increase. Whether you struggle to pay premiums for a long-term care insurance policy or monthly bills from a nursing home, costs all around are exorbitantly expensive. The US Department of Health & Human Services (HHS) finds that Americans aged 65 or more have a 70 percent chance of requiring long-term care services. Family members also absorb these costs for their loved ones at the peril of their financial well-being because Medicare does not cover long-term care. As a result, many Americans turn to Medicaid as the solution to the prohibitive cost of long-term care.

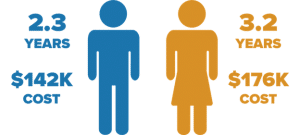

A study by the Urban Institute commissioned by HHS finds that American men turning 65 in 2020-2024, on average, will require 2.3 years of long-term care while women will require 3.2 years.

Many aging Americans believe Medicaid coverage for long-term care kicks in only after they become impoverished to meet qualifications for the program. You do not automatically have to sell your home to qualify for Medicaid; however, this does not mean your home is completely protected.

How Does Owning a Home Impact Medicaid Eligibility?

Medicaid does not count the home of a program benefits applicant as an asset when determining program eligibility, as long as the resident intends to return to that home. Some states will require proof of the likelihood of returning home. Additionally, the resident’s home equity must be less than $603,300 (in some states, $906,000). This number calculation considers the home’s fair market value minus any debts secured, such as a mortgage or home equity loan.

So while your home may not have to be sold to become a resident in a Medicaid-funded long-term care facility, the state will place a lien on your home during your lifetime. If you live with a spouse, a disabled or blind child under 21, or a sibling with an equity interest in the house, the state cannot place a lien on the property.

The partnerships between state and federal governments to provide long-term care coverage through Medicaid are financially unworkable in their present form, meaning they operate at a loss. Long-term care is the program’s most expensive benefit. Because US seniors hold $8.05 trillion home equity, attaching government compensation on the backside (meaning your death) of having provided long-term care constitutes repayment of sorts to the government. McKnight’s Senior living reports that 78.7 percent of the 54 million elderly Americans own homes.

The Omnibus Budget Reconciliation Act of 1993 requires state Medicaid programs to recover some of the cost of care provided from the deceased recipients’ estates (including home equity). In essence, the law says you will not be financially wiped out if you need long-term care; however, in the absence of a qualified surviving dependent’s need, your estate will pay back the cost of your care. The goal was to protect the dignity of those who did not plan to pay privately for long-term care. Now that long-term care is prohibitively expensive, even people who planned for retirement needs are often unable to pay the premiums for the care.

What are the Issues with the Medicaid Program?

Today the Medicaid and CHIP Payment and Access Commission (MACPAC) recommend Congress make Medicaid estate recovery voluntary. This recommendation reduces potential recoveries and limits reimbursement prospects based on Medicaid-managed hardship care cases providing waivers on aspects other than financial hardship. Ultimately this proposal will increase federal expenditures and reduce the funds available to Medicaid. Already states tend not to seek recovery via estates unless the return is more significant than recovery cost.

In the long run, decimating the ability for Medicaid to recover some repayment from an asset pool of 8 trillion dollars can potentially bankrupt the Medicaid program itself. There is a need to strengthen America’s long-term care social contract. Americans need public-private partnerships to rethink the handling of long-term care in this country. The middle class, in particular, needs a way to pay for long-term care without having to rearrange their finances to qualify for Medicaid by transferring assets to their adult children or entering into Medicaid Qualifying Trusts or trusts to protect homes from Medicaid liens. It is incumbent upon the US Congress to find ways to protect its ever-growing senior population without bankrupting the social safety nets put in place for their protection.

We hope you found this article helpful. If you have questions or would like to discuss a personal legal matter, don’t hesitate to reach out. Please contact our office at (718) 875-2191.