Estate Planning When Facing a Nursing Home Transition

The decision to place a parent in a nursing home rarely comes easily. Apart from the emotional toll, significant financial and legal adjustments are often necessary. While immediate well-being takes priority, it’s vital to safeguard your parent’s assets and long-term care needs with proactive estate planning. Questions to Guide Your Consultation Elder law attorneys focus […]

Understanding Medicaid Asset Protection Trusts: A Guide with Real-Life Examples

Navigating the complexities of Medicaid eligibility can be a daunting task, especially when it involves the protection of your hard-earned assets. One effective tool in this arena is the Medicaid Asset Protection Trust (MAPT). In this blog, we’ll explore what MAPTs are, how they work, and provide real-life examples to illustrate their benefits. What is […]

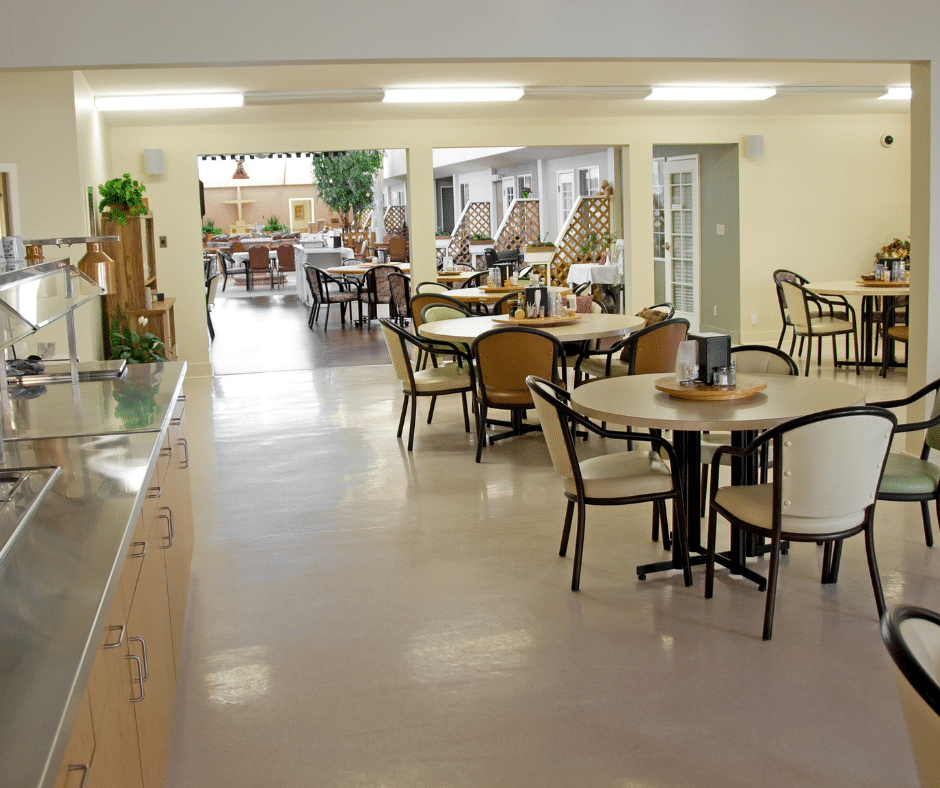

Navigating Assisted Living Concerns

When the time comes to consider assisted living for a loved one, families often find themselves with a list of questions and concerns. It’s a big transition, and understanding the financial implications is crucial. Here’s where an elder lawyer can offer clarity and guidance to help you make informed decisions. Will Assisted Living Force the […]

Understanding Sundowning and When to Seek Support

As an elder lawyer, I often counsel families grappling with the challenges of caring for a loved one with dementia. A common and particularly distressing symptom of dementia is sundowning, characterized by increased confusion, agitation, and restlessness during the late afternoon and evening. Understanding what happens during sundowning and when to seek support can help […]

How to Intervene When an Older Loved One Becomes an Unsafe Driver

Are you worried about the safety of an older loved one on the road? If so, you are not alone. Countless families face this issue every year, and it can be devastating for both the senior and their loved ones to deal with. The senior is often forced to confront the reality of losing their […]

How to Intervene When an Older Loved One Becomes an Unsafe Driver

Are you worried about the safety of an older loved one on the road? If so, you are not alone. Countless families face this issue every year, and it can be devastating for both the senior and their loved ones to deal with. The senior is often forced to confront the reality of losing their […]

Can the Nursing Home Take Your Loved One’s Life Insurance?

If you have a parent in a nursing home, you’re likely facing a lot of difficult decisions and stressful situations. It’s natural to feel overwhelmed, but it’s important to remember that you have options and resources available to you. One question that often comes up is whether the nursing home can take a loved one’s […]

Strategies to Safeguard Assets for Spouses When Facing Long-Term Care

You worked hard to provide for your spouse throughout your marriage, and you want to continue to do so well into your retirement years. When the need for nursing home care or assisted living is on the horizon, the cost of such care can weigh heavily. The good news is that asset protection planning can […]

How to Help Seniors Find Joy During the Holidays

The holiday season is joyous for many. However, it can be overwhelming if you care for an older adult. People in their senior years often feel isolated from the outside world if they can’t participate in certain festivities. Maybe they used to be active and loved playing with their kids and grandkids but no longer […]

Wedding Bells Later in Life? What Newlywed Seniors Need to Know About Their Estate Plans

Some seniors don’t expect to remarry after a divorce or the death of a spouse. However, life is full of surprises. You could meet someone at any age, even during your retirement years. Many older adults bring various assets and debts into a new relationship. They might also have children from a previous marriage, one […]